Performance of brokerage companies plays an important role in improving trading turnover and liquidity. Even though brokerage companies of Mongolian stock exchange have double duties for broker and dealer, activities of brokerage companies mainly limited by implementing buy and sell order of its clients.

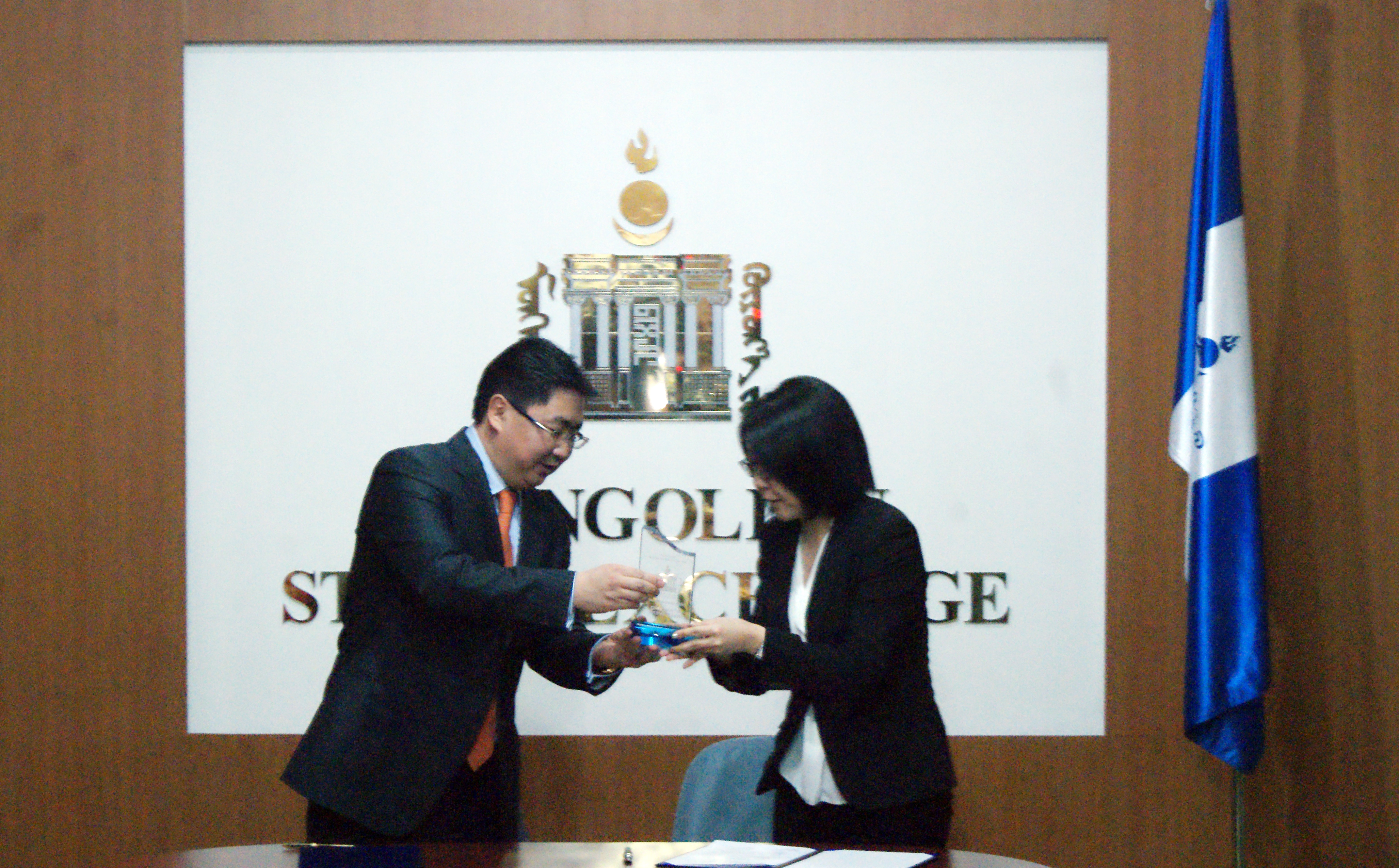

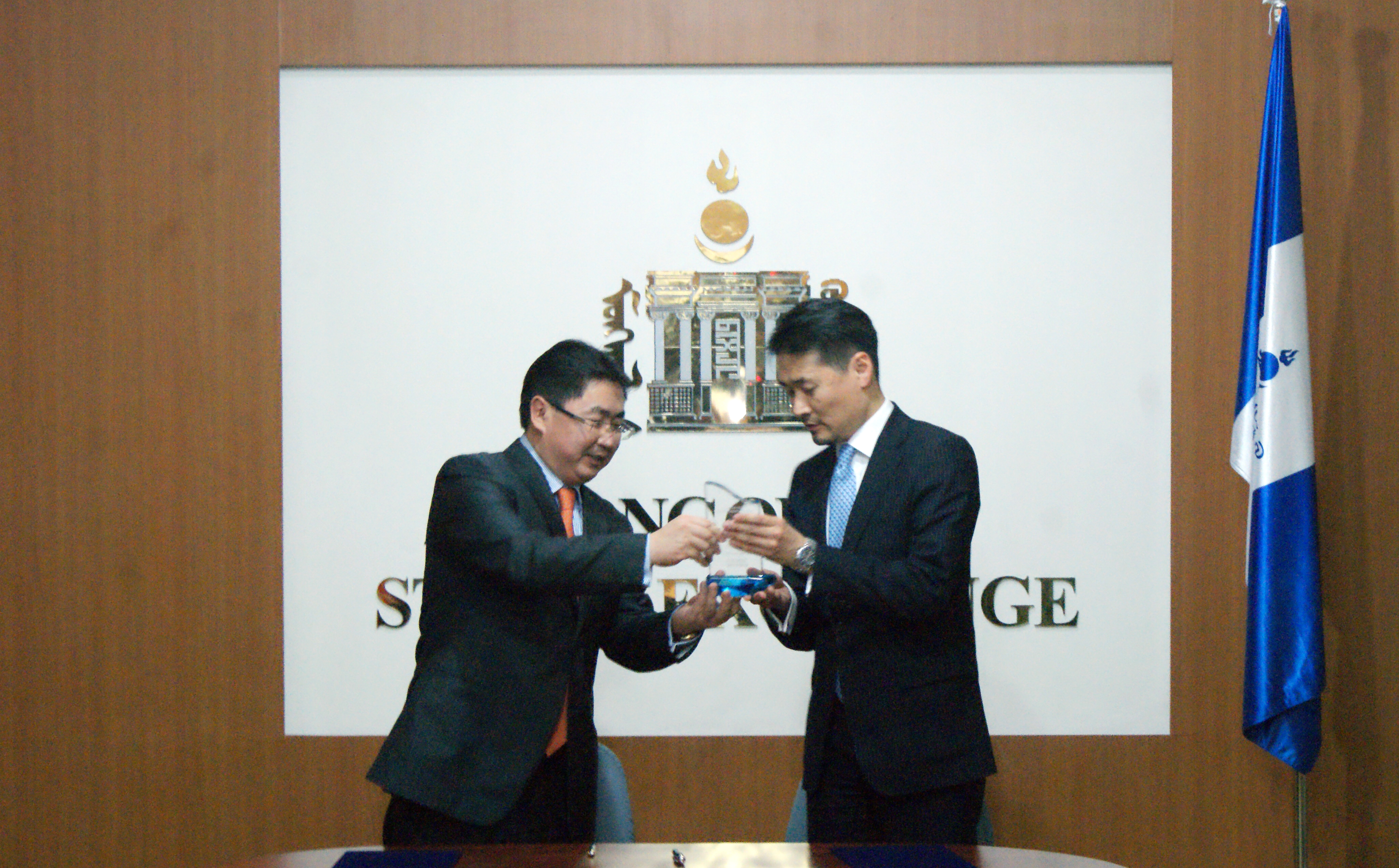

Thereupon investors face problems with buying and selling their shares at any time they want, and it has a negative impact on market liquidity. Therefore, Mongolian Stock Exchange has been preparing to introduce international capital market structure of “Market Makers” from 16 February 2015. Today, member companies of Mongolian Stock Exchange, such as “BDSec”JSC, “Standart Investment”LCC, “Capital Market Corporation” LLC and “Tenger Capital” LLC received the ratification as “Market maker” and signed the agreement with MSE.

Brokerage companies with “Market maker” ratification will participate in daily shares and government securities trading and hence, liquidity of securities in the primary and secondary market will increase as well. In near future, introduction of market makers structure will be available in stocks and derivatives market.

By the way, Government securities started trading through MSE from November 2014 and total of MNT74 billion worth government securities were owned by bond investors. Secondary market of government securities commenced on 19 January 2015.